Weekly Online Meeting with the International Admissions Team

Meeting with the International Admissions Team—tailored specifically for candidates who have not yet submitted their online applications.

Computer Engineering

Engineer’s Degree

Management

Bachelor’s Degree Programme

Business and Security Analytics

Bachelor’s Degree Programme

Psychology in Business

Bachelor’s Degree Programme

International Relations

Bachelor’s Degree Programme

International Tourism and Hospitality Management

Master’s Degree Programme

Tourism and Hospitality Management

Bachelor’s Degree Programme

Logistics

Bachelor’s Degree Programme

Economics

Bachelor’s Degree Programme

English Studies

Bachelor’s Degree Programme

Architecture

Engineer’s Degree

Management

Master’s Degree Programme

Journalism and social communication

Bachelor’s Degree Programme

Finance and Accounting with ACCA

Master’s Degree Programme

Finance and Accounting with ACCA

Bachelor’s Degree Programme

Graphic design

Bachelor’s Degree Programme

International Relations

Master’s Degree Programme

Computer Engineering

Master’s Degree Programme

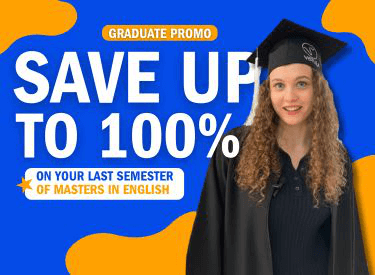

English Studies

Master’s Degree Programme

Vistula University has launched the “Early Bird – 1st Year Tuition Discount” promotion for international candidates beginning their studies in Fall 2026/2027.

Study Management and get a dual degree from London South Bank University (LSBU) and Vistula University

Vistula University is launching an exclusive double-degree programme in cooperation with Post University.

If you are planning to continue your academic adventure at Vistula, now is the perfect time!

Join our International Admissions Team and get all your questions answered before submitting your application.

In terms of international student diversity out of all 688 universities included.

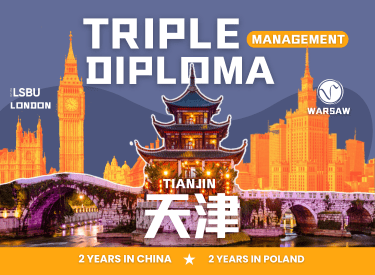

Vistula University is launching a unique study program carried out on two continents, ending with the attainment of three prestigious diplomas.

Choose accredited management. Gain the knowledge and skills necessary for professional success.

By choosing the ACCA specialization, you will receive the title of an international-class specialist in corporate financial management.

66 000

graduates of Bachelor’s, Engineering and Master’s degree study programs

+100

countries of origin of our students and lecturers

4

universities in the Vistula Group of Universities

300

companies in business cooperation with the Vistula Group of Universities

At Vistula University, you will receive the education sought for in the labour market. Our carefully selected fields of study and specialties are constantly adapted to the economic situation and labour market needs.

Find out more

Students in the fields of Management and Computer Science can study for two semesters at the Centria University of Applied Sciences and, as a result, obtain a double diploma from both universities. Choosing a management programme, they can also obtain, for an additional fee, a diploma from Vistula and London South Bank University.

Find out more

As part of Vistula’s cooperation with KPMG Polska, the company offers scholarships for outstanding students. The program opens up the possibility of working for KPMG in Poland.

Find out more

Market position and prestige of Vistula University have been built by our academic staff. They are experienced lecturers, outstanding scientists and industry experts. The high qualifications of our lecturers translate into the high academic level of the University and the quality of provided education.

Find out more

Students and lecturers come from over 100 countries, and all fields of study are provided also in English. In such a multinational and multicultural environment, you will build your self-confidence and you will be ready to start an international career.

Find out more

Our University is the leader in online education. We have an extensive experience in this field and we use the latest tools. Online studies will provide you with accessibility, mobility and flexibility. You can learn whenever and wherever you want.

Find out more

Vistula is a multicultural university where you meet people from all over the world. You can take part in the activities of the Student Council and our science clubs. You will be able to pursue your passions and gain experience that will pay off in the future.

Find out more

In our Confucius Classroom, you will learn about the culture of China and study the Mandarin language. You will prepare for the official HSK exam and have many opportunities to travel to the Middle Kingdom and study at Chinese universities.

Find out more

Our modern Vistula campus is located in Warsaw’s Ursynów, right next to the metro station. The facility is well-communicated and adapted for people with disabilities. Our University offers financial support to those in need.

Find out moreIf you wish to study in Warsaw, Vistula University is the place where you can find a wide range of Bachelor’s, Engineering and Master’s studies both in Polish and in English, full-time and part-time. This non-public university prepares students for careers in management, finance and accounting, international relations, economics, philology, journalism, graphics, architecture and computer science. Vistula stands out from other non-public universities. We focus on the practical dimension of education and we support our students at the start of their professional careers. In response to the labour market demands, we have launched new specialties, including those in the field of cybersecurity, green economy, e-commerce business, artificial intelligence or computer game development engineering. The knowledge and competences acquired during studies at Vistula University give our graduates an edge and thus help them achieve professional success.

Find out more

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it. Check details.